Solar Tax Credits 2025

Solar Tax Credits 2025 - Federal Solar Tax Credits for Businesses Department of Energy, The inflation reduction act extended the federal solar tax credit until 2035. The solar tax credit, which is among several federal residential clean energy credits available through 2032, allows homeowners to subtract 30. The report said that an additional five gigawatts (gw) over last year's capacity could be installed in 2025.

Federal Solar Tax Credits for Businesses Department of Energy, The inflation reduction act extended the federal solar tax credit until 2035. The solar tax credit, which is among several federal residential clean energy credits available through 2032, allows homeowners to subtract 30.

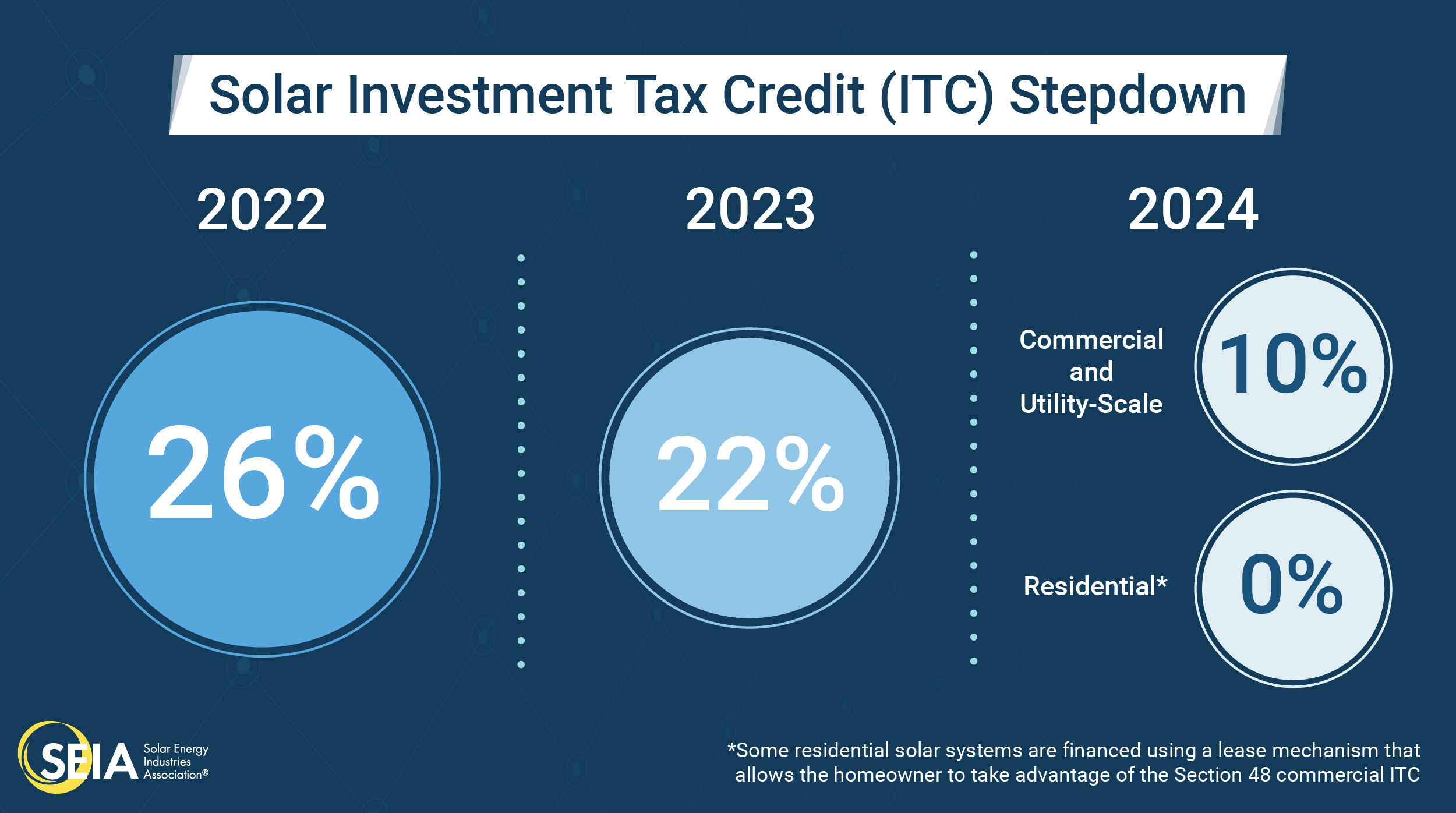

• solar pv systems installed in 2025 and 2025 are eligible for a 26% tax credit. Home electrification from the ira.

Federal Solar Tax Credit Extended Through 2025, Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal. Government offers a solar tax credit that can reach up to 30% of the cost of installing a system that uses the sun to power your home.

Solar Tax Credits 2025. Solar pv systems installed in 2025 and 2025 are eligible for a 26% tax credit. Total impact on tax liability assuming the business has a federal corporate tax rate of 21%, the net impact of depreciation deductions is calculated as:

In august 2025, congress passed an extension of the itc, raising it to 30% for the.

Federal Tax Credit for Saving Money on Solar Panels KC Green Energy, For tax years 2025 to 2032, you can get a credit for up to 30% of the expense of installing solar panels; Energy improvements to your home such as solar or wind generation, biomass stoves, fuel cells, and new windows may qualify you for credits.

Programs That Make Solar More Affordable, You can claim the credit the same year you install your. Home electrification from the ira.

26 Federal Solar Tax Credit Extended SolarTech, For tax years 2025 to 2032, you can get a credit for up to 30% of the expense of installing solar panels; Energy improvements to your home such as solar or wind generation, biomass stoves, fuel cells, and new windows may qualify you for credits.

2023 Residential Clean Energy Credit Guide ReVision Energy, ($35,000 x 30% = $10,500.) note: Installing solar panels on your home likely qualifies you for the residential clean energy credit from the federal.

.png)

Federal Solar Tax Credit Take 30 Off Your Solar Cost (2025), The solar investment tax credit is a credit you can claim on your federal income. Because the solar tax credit rate for 2025 is 30%, you would be able to claim a $10,500 tax credit.

Everything You Need to Know The New 2025 Solar Federal Tax Credit, Government offers a solar tax credit that can reach up to 30% of the cost of installing a system that uses the sun to power your home. The standard deduction for single filers rose to $13,850 for 2023, up $900;

Federal Solar Tax Credit (What It Is & How to Claim It for 2025), By sam wigness | dec 22, 2023. In august 2025, congress passed an extension of the itc, raising it to 30% for the.